/ home / newsletters /

Bitcoin Optech Newsletter #27: 2018 Year-in-Review Special

This week’s newsletter is a special year-end edition summarizing notable developments in Bitcoin during all of 2018. Despite the extended length of this newsletter, we regret that it only covers a tiny fraction of the work put into dozens of open source projects by hundreds of contributors. Without those low-level contributions, the high-concept ideas described in this newsletter would be just empty words, and so we extend our most sincere thanks to all of you who contributed to Bitcoin development this year.

January

Hundreds of Lightning Network (LN) channels were open on testnet before the start of the year, but January 2018 saw a few businesses and users start using LN payments with real bitcoins on mainnet. The pioneers tagged their own actions as #reckless, but this did little to stop other experimenters from putting real money at risk on the nascent payment network.

This month also saw the publication of the Schnorr-based muSig interactive multiparty signature protocol by Gregory Maxwell, Andrew Poelstra, Yannick Seurin, and Pieter Wuille. This provides the same security as Bitcoin’s current multisig but can often reduce the amount of transaction data required down to a single normal-looking public key and signature. This not only reduces overhead and costs, it also increases privacy by making basic multisig transactions look identical to single-sig transactions.

| Receive script | Spend data | |

|---|---|---|

| Single-sig, current Script (P2PK) | <pubkey> OP_CHECKSIG |

<signature> |

| Bare multisig, current Script | 2 <pubkey> <pubkey> <pubkey> 3 OP_CHECKMULTISIG |

OP_0 <signature> <signature> |

| Multisig, muSig1 | <pubkey> OP_CHECKSIG |

<signature> |

Building on the idea that muSig, or something like it, could become possible in Bitcoin, Maxwell further described Taproot—a powerful optimization for Merklized Alternative Script Trees2 (MAST). Just as muSig allows basic multisig to look like single-sig, Taproot allows even the most complex possible Bitcoin script to look like single-sig if its participants cooperate with each other (but if they don’t, they still receive the full security of their chosen script). This provides an even larger set of users with reduced overhead, reduced costs, and increased privacy.

| Receive script | Spend data | |

|---|---|---|

| Single user, current Script (P2PK) | <pubkey> OP_CHECKSIG |

<signature> |

| Cooperating users, earlier MAST proposals3 | <hash> OP_MAST |

<signature> <<pubkey> OP_CHECKSIG> <hash> <flags> |

| Cooperating users, Taproot1 | <pubkey> OP_CHECKSIG |

<signature> |

February

As if Taproot’s potential benefits weren’t enough, February saw Gregory Maxwell describe a construction of it called Graftroot that would allow the people currently authorized to spend a coin to create additional sets of conditions that allow spending the coin—without creating a new transaction. At any point, any of the authorized sets of conditions could be used to spend the coins. For example, if a coin can currently be spent by agreement between both Alice and Bob (2-of-2 multisig), they could both agree to allow it to be spent by any two of Alice, Bob, or their lawyer Charlie (2-of-3 multisig)—and they could make this choice years after first receiving the coin without creating a new transaction. This could further increase efficiency and privacy, especially for certain offchain contract protocols.

Meanwhile, LN protocol developers Olaoluwa Osuntokun and Conner Fromknecht described a new way to make multipath payments over LN. Multipath payments are payments with parts split across multiple channels—for example, Alice can send part of a payment to Zed through her channel with Bob and part through her channel with Charlie.

| Single path | Multipath |

|---|---|

| Alice → Bob → Zed | Alice → {Bob, Charlie} → Zed |

The authors noted that LN provides native support for multipath payments by using the same commitment preimage (hashlock) for each part of the payment, but that using this mechanism allows third parties to detect that they are handling different parts of the same payment. They then described a more complex protocol that could prevent this correlation and potentially provide other benefits. Whether the simpler method or the more complex method is used, either could significantly enhance the usability of LN by removing the constraint that a user must have a single channel with enough funds to make a payment. For example, in the current protocol, if Alice has two channels each with a bit over $100 available, she can only securely send Zed a maximum of $100 in a single payment. With a multipath payment, Alice can send $200 by splitting the payment across the two channels.

February closed with a bit of historical parallelism. Early Bitcoin contributor and the first known person to buy pizza with Bitcoin, Laszlo Hanyecz, bought two pizzas using LN for 6.49 mBTC—a much lower price in BTC terms than the 10 million mBTC he paid for two pizzas in May 2010.

March

Many Bitcoin users are familiar with being able to create signed messages corresponding to their Bitcoin addresses. There’s currently no standard way to do this with P2SH or segwit addresses. A discussion in March would eventually turn into BIP322, a proposal to create a generic format capable of creating a signature proof for any spendable Bitcoin script.

2018 summary

Major releases of popular infrastructure projects

-

● Bitcoin Core 0.16 released in February included default support in the wallet for receiving to segwit addresses, BIP159 support to allow pruned nodes to signal their willingness to serve recent blocks, and a number of performance improvements.

-

● LND 0.4-beta released in March was the first LND release targeting mainnet support. It also supported using Bitcoin Core as a backend, using Tor for connections, and many other features.

-

● C-Lightning 0.6 released in June reduced resource requirements, provided a built-in wallet, and added Tor support.

-

● LND 0.5-beta released in September included many changes focused on making the system much more reliable. It also dropped the requirement for full node backends to keep a transaction index, improving performance and reducing disk space requirements.

-

● Bitcoin Core 0.17 released in October included optional partial spend avoidance, the ability to dynamically create and load wallets, and BIP174 partially signed Bitcoin transaction support for communication between Bitcoin programs.

April

LN protocol developers Christian Decker, Rusty Russell, and Olaoluwa Osuntokun announced Eltoo, a proposed alternative enforcement mechanism for LN. The current mechanism (LN-penalty) requires making previous offchain balance updates unsafe so that users don’t try to put them onchain. The Eltoo mechanism allows onchain spending of previous balance updates to later balance updates within a limited time window. In normal operation, parties would normally simply publish the final channel balance onchain, but even if a party were to publish an old balance, their channel counterparty could simply publish a second transaction correcting it to the final balance. Neither party would lose anything but the transaction fees they paid.

The advantage of Eltoo is that user software doesn’t need to manage the data that makes earlier balance updates unsafe. This simplifies backups and reduces the risks associated with data loss—but perhaps most importantly, it makes it much easier and computationally efficient for payment channels to be opened between many users in a single onchain transaction. This lays the groundwork for other proposals such as Channel Factories that could make LN channels 10x or more efficient in their onchain operations.

Eltoo requires a soft fork to add a new optional signature hash, BIP118 SIGHASH_NOINPUT_UNSAFE.4 This would allow a signature authorizing the spend of a UTXO to indicate that the signature doesn’t apply to just that UTXO but to any UTXO that could be spent by a signature from the same private key. Additionally, Eltoo’s publication mechanism may not be reliably safe because current node relay policies allow transaction pinning. Still, protocol developers appear optimistic about the proposal and many are hoping that the noinput feature can be part of a possible future Schnorr and Taproot soft fork proposal.

May

A draft BIP for the Dandelion protocol was published to the Bitcoin-Dev mailing list in May. Dandelion can privately relay transactions so that the IP address of the spender can’t be reliably determined. This works even without using a method like Tor, and Dandelion can be combined with Tor to further decrease the risk of a privacy compromise. Dandelion by itself only fully benefits users of relaying full nodes (not P2P lightweight clients5) and it needs to be combined with some form of encryption to prevent ISPs from being able to identify spenders.

However, Dandelion depends in part on relay nodes pretending that they’ve never seen a transaction they previously helped relay. This makes the nodes vulnerable to denial of service attacks that can waste the node’s bandwidth and memory—problems which developers are still working on addressing before adopting this protocol.

2018 summary

Notable technical conferences and other events

- ● BPASE, January, Stanford University

- ● Bitcoin Core developers meetup NYC, March, New York City (transcripts)

- ● L2 Summit, May, Boston

- ● Building on Bitcoin, July, Lisbon (transcripts)

- ● Edge Dev++, October, Tokyo (videos, transcripts)

- ● Scaling Bitcoin Conference, October, Tokyo. (videos, transcripts)

- ● Bitcoin Core developers meetup Tokyo, October, Tokyo (transcripts)

- ● Chaincode Lightning Residency, October, New York City (videos)

- ● Lightning protocol development summit, November, Adelaide

June

In June, Matt Corallo publicly announced a project he’d been working on for some time: a new protocol for communication from a mining pool server to individual miners and on to the actual ASICs doing the work. Named BetterHash, the protocol separates pool payouts from transaction selection. An illustration of why this is important came later in the year when several traditional mining pools threatened to redirect their Bitcoin hashrate to work on an altcoin—something which miners using BetterHash could’ve automatically resisted. Corallo provided BetterHash with both a draft BIP and a working implementation that includes backwards compatibility with the predominant Stratum mining communication protocol.

At the same time, a vulnerability long known to some Bitcoin protocol developers was unwittingly disclosed publicly. CVE-2017-12842 makes it possible to create an SPV proof for a transaction that doesn’t exist by specially crafting a real 64-byte transaction that gets confirmed in a block. Many lightweight wallets that depend on SPV proofs remain vulnerable even today, but the estimated cost of the attack is more expensive than the original attack against SPV-trusting wallets described by Nakamoto in section 8 of the 2009 Bitcoin paper, so lightweight clients don’t appear to be significantly less secure than they were before. For other cases where SPV proofs are used in conjunction with a full node, such when used with federated sidechains, Bitcoin Core modified its RPCs to perform additional checks or provide additional information that fully mitigates the vulnerability (see PRs #13451 and #13452).

On the fun side, the satoshis.place website by Lightning K0ala rose to sudden popularity as an amusing place to spend real bitcoins using LN. Hundreds of users paid one satoshi per pixel to paint anything they wanted to the shared canvas, providing an amazingly effective live demonstration of the speed and convenience of LN payments.

July

After over a year of advanced notice, July began with the release of the private key previously used to sign alert messages that spread through the Bitcoin P2P network. Alert messages didn’t just warn users about problems but also, in some older releases of the software, gave those with the alert key the ability to effectively stop all commerce on the Bitcoin network—a concerning centralization of power for a decentralized network. Details of multiple denial-of-service vulnerabilities against older nodes that could be performed with the alert key were released at the same time as the key.

In positive news, Pieter Wuille released a draft BIP defining a Schnorr-based signature scheme with the goal of allowing everyone to discuss—and hopefully agree upon—how that aspect of adding Schnorr to Bitcoin would work while other details of a possible soft fork are still being worked out. The proposed format would be fully compatible with existing bitcoin private and public keys, so HD wallets shouldn’t need to generate new recovery seeds. Signatures would be roughly 10% smaller, slightly increasing onchain capacity. Signatures could also be verified in batches about 2x faster than they could be verified individually, even in parallel, mainly speeding up verification of blocks for nodes catching up.

The signature scheme is compatible with the muSig protocol described in January (or similar protocols) and so encompasses its benefits for increased efficiency and privacy. Use of Schnorr also simplifies the implementation of techniques such as Taproot, Graftroot, more private payment channels for LN, more private atomic swaps across chains, more private atomic swaps on the same chain (providing for improved coinjoin), and other advances that improve efficiency, privacy, or both.

Meanwhile, participants in a privacy roundtable described a method called Pay-to-EndPoint (P2EP) that can significantly improve wallet resistance to block chain analysis by applying a limited form of coinjoin to interactive payments. A simplified form of the proposal has also been described. The protocol works by having the receiver of a transaction mix some of their existing bitcoins into the transaction, preventing an outside observer from being able to automatically assume that all the inputs to a transaction came from the same person. The more people who use this technique, the less reliable the input association assumption becomes—improving privacy for all Bitcoin users, not just the people who use P2EP.

| What Alice and Bob know | What the network sees | |

|---|---|---|

| Current norm | Inputs: Alice (2 BTC) Alice (2 BTC) Outputs: Alice’s change (1 BTC) Bob’s revenue (3 BTC) |

Inputs: Spender (2 BTC) Spender (2 BTC) Outputs: Spender or Receiver (1 BTC) Spender or Receiver (3 BTC) |

| With P2EP | Inputs: Alice (2 BTC) Alice (2 BTC) Bob (3 BTC) Outputs: Alice’s change (1 BTC) Bob’s revenue & change (6 BTC) |

Inputs: Spender or Receiver (2 BTC) Spender or Receiver (2 BTC) Spender or Receiver (3 BTC) Outputs: Spender or Receiver (1 BTC) Spender or Receiver (6 BTC) |

August

A long-term effort to bring encryption to Bitcoin’s network protocol received new developments in August with the opening of a PR to Bitcoin Core and the publication of a revised BIP151. Communication encryption is already possible (and recommended) using Tor—which can provide other benefits—but enabling encryption by default could help protect a larger number of users from eavesdropping by their ISPs.

Separately, Pieter Wuille has been working on a draft document since February based on a protocol he, Gregory Maxwell, and others have been developing to allow optional authentication on top of encryption. Similar to BIP150, this would make it easier to securely set up whitelisted nodes across the Internet or lightweight wallets bound to trusted nodes. Notably, the current idea for this is to enable authentication without revealing identity to third parties so that nodes on anonymity networks (such as Tor) or nodes that simply changed IP addresses couldn’t have their network identity tracked. Although Wuille discovered flaws in his originally documented proposal, it’s been updated as research into developing the protocol has proceeded.

2018 summary

Bitcoin Optech

After starting Optech in May, we’ve signed up 15 companies as members, held two workshops, produced 28 weekly newsletters, built a dashboard, and made a solid start on a book about individually-deployable scaling techniques. To learn more about what we accomplished in 2018 and what we have planned for 2019, please see our short annual report.

September

The major news of September was the discovery, disclosure, repair, and analysis of the CVE-2018-17144 duplicate inputs vulnerability in unpatched Bitcoin Core versions 0.14.0 to 0.16.2. The vulnerability allowed a miner to create a block that spent the same bitcoins more than once, allowing unexpected inflation of the amount of bitcoin currency. This would later be exploited on testnet (temporarily), demonstrating the vulnerability but without putting real bitcoins at risk. There is no evidence anyone tried the attack against Bitcoin mainnet. Anyone using a release version of Bitcoin Core 0.16.3 or later is no longer at risk.

Such problems can ultimately only be avoided by increasing the amount of review and automated testing that code changes receive—and for that, Bitcoin needs more reviewers, more test writers, and more organizations committed to hiring or sponsoring such contributors.

October

The fifth Scaling Bitcoin conference in early October both introduced new ideas for the future of Bitcoin and refined existing ideas. At related events, immediately-practical talks focused on exchange security, wallet security, and safe handling of block chain reorganizations and forks. Bitcoin Core developers also held meetings to give each developer a chance to discuss their current initiatives with other developers.

Separately, LN protocol developer Rusty Russell proposed a method for splicing, which allows users to add or subtract funds from a channel without pausing payments in that channel. This especially helps wallets hide from their users the technical details of managing balances. For example, Alice’s wallet can automatically pay Bob offchain or onchain from the same payment channel—offchain using LN through that payment channel or onchain using a splice out (withdrawal) from that payment channel.

2018 summary

New open source infrastructure solutions

-

● Electrs released in July provides an efficient reimplementation of an Electrum-style transaction lookup server written in the Rust programming language. Resource requirements are significantly lower than they are for alternatives. Electrum-style servers provide the backend for many wallets and some other services.

-

● Subzero released in October by Square provides a suite of tools and documentation to use with a Hardware Security Module (HSM) for key management. It’s designed to help exchanges and other bitcoin custodians securely store their bitcoins.

-

● Esplora released in December by Blockstream provides the frontend and backend code for a block explorer. Based in part on Electrs, it supports mainnet, testnet, and the Liquid sidechain.

November

LN protocol developers met in November to decide which changes to adopt for the forthcoming Lightning Network Protocol Specification 1.1. Accepted changes focus heavily on usability improvements. Two changes, multipath payments (described above in February) and Splicing (October), together can allow wallets to almost completely hide the complexity of channel balance management from users. For example, with one click (ideally) Alice can pay Bob up to almost her full wallet balance from any combination of her channels whether she’s paying him offchain or onchain.

Other accepted changes include increasing the maximum channel capacity, dual-funded channels that can help businesses improve their LN user experience, and hidden destinations that can help nodes stay hidden even when routing payments for arbitrary untrusted spenders. These topics and many others were discussed in this busiest-ever month on the Lightning-Dev mailing list.

One of the desired changes requires a variance to Bitcoin Core’s relay policy. LN devs would like offchain payments to commit to a minimum amount of onchain fee while the channel is in use. When the channel is closed, they want to use fee bumping to set the fee to an appropriate amount for current network conditions. This is made difficult by some of Bitcoin Core’s code for preventing denial-of-service attacks that unfortunately make fee bumping unreliable in adversarial cases, but protocol developer Matt Corallo has proposed a new rule that may safely allow fee bumping in the case of two-party LN payments.

December

Pieter Wuille, Gregory Maxwell, and Gleb Naumenko researched how to reduce the amount of data used to relay Bitcoin transactions. Their initial result is libminisketch, a library that allows one user with a set of elements (e.g. {1, 2, 3}) to efficiently send missing elements to another user who only has part of that set (e.g. {1, 3}). No changes to Bitcoin consensus are required for this—it’s just a different way of transmitting the same information. If implemented for relay, it can reduce overall node bandwidth (for a typical case) by 40% to 80%. It also keeps bandwidth low as the number of connections increases, potentially allowing nodes to make many more connections to peers in order to improve the robustness of the P2P relay network.

Finally, as 2018 drew to a close, developers continued to discuss how Schnorr signatures, Taproot MAST, SIGHASH_NOINPUT_UNSAFE, and other changes might be integrated together into a concrete soft fork proposal. Protocol developer Anthony Towns concisely summarized what might be contained in a proposal if it were released today.

2018 summary

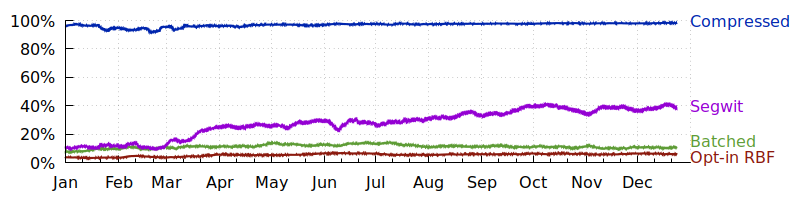

Use of fee-reduction techniques

We surveyed a variety of techniques for reducing transaction fees whose use can easily be tracked by looking at confirmed transactions.

-

● Compressed pubkeys save 32 bytes per use and have been widely used since 2012. The number of inputs using compressed pubkeys rose from about 96% in January to 98% in December.

-

● Segwit spends reduce the effect of witness size on fees by up to 75%, depending on how segwit is used (see next graph). The number of inputs using segwit rose from about 10% in Jan to 38% in Dec.

-

● Batched payments spread the size and fee overhead of spending an input or set of inputs across a greater number of outputs, making them a great way for high-frequency spenders like exchanges to save up to 80% on fees. The number of transactions spending to three or more outputs hovered around 11% all year. Note: this heuristic also counts coinjoin transactions and other techniques that are not strictly payment batching.

-

● Opt-in RBF (Replace-by-Fee) allows efficient fee bumping so spenders can start by paying a low fee and then increase their bid later. Transactions signaling RBF rose from about 4% in Jan to 6% in Dec.

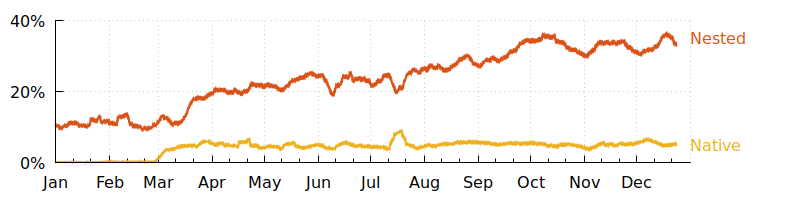

There are two classes of segwit spends:

-

● Nested segwit puts the extension mechanism inside a backwards-compatible P2SH script, making it compatible with almost all software but not allowing it to achieve its full efficiency. The number of inputs using nested segwit rose from about 10% in Jan to 33% in Dec.

-

● Native segwit is more efficient but is only compatible with wallets that support sending to segwit addresses. The number of native segwit inputs rose from almost 0% in Jan to about 5% in Dec.

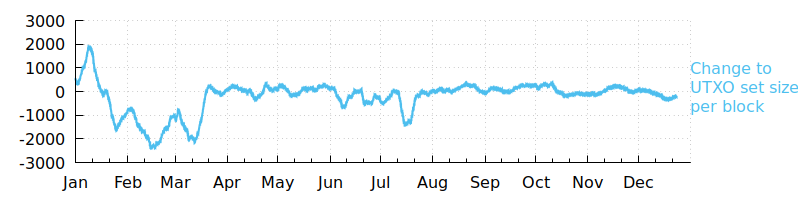

A final fee-reduction technique we surveyed was the per-block change to the size of the set of Unconfirmed Transaction Outputs (UTXOs). Decreases indicate consolidation of bitcoins into larger coins that can be spent more efficiently later. Altogether, the UTXO set size decreased by about 12 million entries this year.

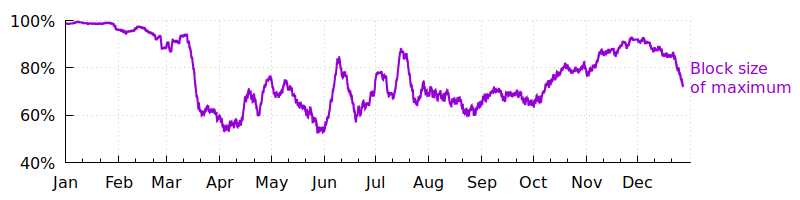

Overall, the average amount of block space used this year rarely approached the maximum allowed by the protocol, but it did seem to be increasing towards the max up until the beginning of December. If that trend returns and blocks become consistently full again in 2019—as they were in 2017—fees are likely to rise and wallets and businesses that implement fee-reduction techniques may be able to offer their users substantially lower costs than competitors that haven’t optimized.

Data for all the above plots consists of values collected from within each block, smoothed using a simple moving average over 1,000 blocks. Empty blocks (those with only a generation transaction) were excluded from analysis. Most of the above statistics may be obtained from the Optech Dashboard, which is updated after every block. Note: After 1 January 2019, we will update the plots in this article to reflect all of 2018, at which point this sentence will be deleted.

Conclusion

We sometimes hear people requesting roadmaps for future Bitcoin development, but looking back over the developments of 2018 makes it clear how futile publishing such a document would be. Many of the developments described above are things we doubt even the most advanced protocol developer could’ve predicted just a year ago. Accordingly, we have no idea exactly what 2019 has in store for Bitcoin development—but we’re looking forward to finding out.

The Optech newsletter will return to its regular Tuesday publication schedule on January 8th. You can subscribe by email or follow our RSS feed.

Footnotes

-

A Schnorr signature proposal may not use the same opcodes as current Script, but single-sig, multisig using something like muSig, and cooperative MAST using something like Taproot could all use the same format. ↩ ↩2

-

Also called Merklized Abstract Syntax Trees because the original idea by Russell O’Connor combined the cryptographic commitment structure of merkle trees with the programming language analysis technique of abstract syntax trees to provide a method for compactly committing to a complex script whose elements and results from different branches could be combined. Later simplifications of the idea have removed this potential for combining and so recent proposals are unlike abstract syntax trees, leading O’Connor and others to discourage use of the original term for the new idea. Yet the abbreviation “MAST” has been used to refer to the basic technique since at least 2013, and so we’ve chosen to adopt Anthony Towns’s proposed backronym, Merklized Alternative Script Trees. ↩

-

This example doesn’t correspond to any specific MAST proposal but instead provides a simple view of the minimal data necessary for MAST to work. For actual proposals, please see BIPs 114, 116, and 117. ↩

-

BIP118 SIGHASH_NOINPUT_UNSAFE receives the unsafe appellation because naive use of it could allow loss of funds. For example, Alice receives 1 BTC to one of her addresses. She then uses noinput when signing a spend of those funds to Bob. Later, Alice receives another 1 BTC to the same address. This allows the signature from the previous transaction to be reused to send Alice’s new 1 BTC to Bob. BIP118 co-author Christian Decker has agreed to label the opcode as unsafe to encourage developers to learn about this safety concern before they use the flag. A well-designed program can use noinput safely by being careful about what it signs and what addresses it exposes to users for receiving payments. ↩

-

Lightweight clients using the Bitcoin P2P network don’t relay transactions for other users—they only send their own transactions. This means that any transactions sent from a P2P light client can be associated with the client’s network identity (e.g. IP address). Dandelion is just a routing protocol and so cannot eliminate this privacy leak. Instead, P2P light clients should always send transactions using an anonymity network such as Tor (and should use a different throw-away network identity for each spending transaction). ↩