/ home / newsletters /

Bitcoin Optech Newsletter #48

This week’s newsletter describes the new proposed

OP_CHECKOUTPUTSHASHVERIFY opcode, covers continued discussion of

Taproot, and links to a video presentation about handling increasing

Bitcoin transaction fees. Also included are our regular sections on bech32 sending

support, top-voted Bitcoin Stack Exchange questions and answers, and

notable changes in popular Bitcoin infrastructure projects.

Action items

None this week.

News

-

● Proposed new opcode for transaction output commitments: Jeremy Rubin posted to the Bitcoin-Dev mailing list a proposal to soft fork in an

OP_CHECKOUTPUTSHASHVERIFYopcode that allows a Bitcoin address to require the transaction spending it include a certain set of outputs. This enables a restricted form of Bitcoin covenants which can be used to reduce the amount of data that needs to be placed onchain in certain situations, potentially reducing costs or improving privacy in those cases. For details, please see this newsletter’s special section about the proposal. -

● Continued discussion about bip-taproot and bip-tapscript: two comments this week from the Bitcoin-Dev mailing list discussion seemed particularly noteworthy:

-

● Final stack empty: in legacy, segwit, and proposed bip-tapscript scripts, a script evaluates successfully if it contains exactly1 one element that is true. Russell O’Connor raised a point he’s raised before and requested that this opportunity be taken to require tapscript only evaluate successfully if it ends with an empty stack. Pieter Wuille replied that his work on miniscript (see Newsletter #32) showed that, for the subset of scripts miniscript will create, this change in semantics will at most save 0.25 vbytes per tapscript. Also, although the change may simplify development for anyone writing scripts by hand, it’s a bit risky as every development guide to Script written to date teaches that scripts must terminate with a true value on the stack. Wuille summarized, “so overall this feels like something with marginal costs, but also at most marginal benefits.”

-

● Move the oddness byte: Bitcoin public keys are most naturally specified using an X,Y coordinate pair, as was done in the early days of Bitcoin with uncompressed public keys. However, because a valid pubkey must be on the elliptic curve, it’s possible to find both valid Y coordinates (one odd, one even) for any given X coordinate given the curve formula. In compressed key format, the first byte contains a single bit to specify whether the Y coordinate is odd or even, followed by 32 bytes to encode the X coordinate. The proposed bip-taproot followed this convention and used 33 bytes to encode the taproot output key.

This week, John Newbery suggested that we use some method to avoid placing this byte in the scriptPubKey. Wuille agreed that this could be useful and will attempt implementing a variation where the bit will be included as part of the taproot witness data. This will reduce the cost create a taproot output by one vbyte (making it the same as P2WSH currently).

-

-

● Presentation: A Return to Fees: During Blockchain Week NYC earlier this month, Bitcoin Optech contributor Mike Schmidt gave a presentation about Bitcoin transaction fees at Optech’s first executive-focused briefing. The video for his presentation is now available. Schmidt begins his talk by reviewing some statistics from recent Bitcoin fee events, both short events from the past couple of months and the longer event from January 2017 to January 2018 where the next-block fee for an average-sized transaction was consistently over $1 (and often over $2). He reminds listeners that high fees are likely to return—which may have already happened—and that organizations that implement techniques to reduce their fees by even small percentages could save significant amounts of money for themselves or their customers if fees climb as high (or higher) than they did before.

He then describes several techniques services can implement in order to reduce their fees, and he roughly quantifies how much improvement can be expected from each technique. This includes: better fee estimation, better coin selection, payment batching, using segwit, UTXO consolidation, patient spending, Replace-by-Fee (RBF) fee bumping, Child-Pays-For-Parent (CPFP) fee bumping, and Lightning (as a future technique). He also notes that education plays an important role in getting users to accept and adopt several of these techniques, and points out that it can also help reduce user interaction costs such as providing customer support for stuck transactions during fee events.

The 30-minute presentation covers each point concisely, making it an excellent high-level overview for anyone interested in learning about the Bitcoin fee market and how to mitigate expected fee increases.

Proposed transaction output commitments

The proposed opcode OP_CHECKOUTPUTSHASHVERIFY allows a

Taproot address to commit to one or more tapscripts that require the

transaction spending them to include a certain set of outputs, a

technique that contract protocol researchers call a covenant.

The primary described benefit of this proposed opcode is allowing a

small transaction to be confirmed now (when fees might be high) and have that transaction

trustlessly guarantee that a set of people will receive their actual

payments later when fees might be lower. This can make it much more

economical for organizations that already implement techniques such as

payment batching to handle sudden fee spikes.

Before we look at the new opcode itself, let’s take a moment to look at how you might accomplish something similar using current Bitcoin transaction features.

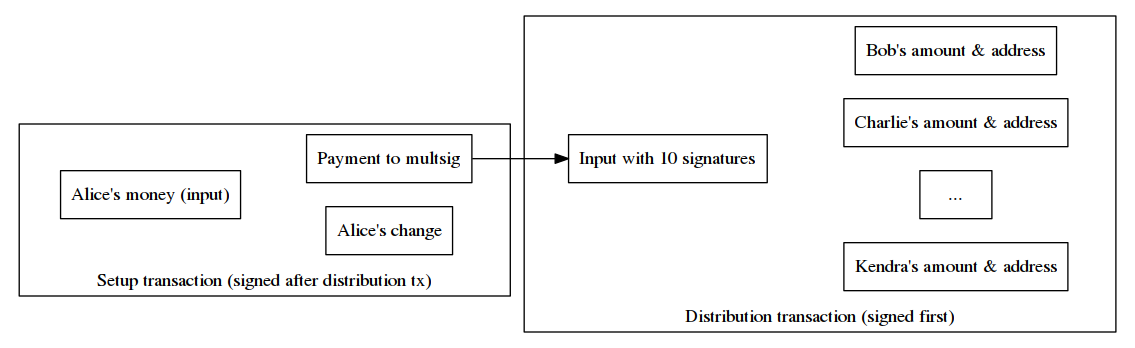

Alice wants to pay a set of ten people but transaction fees are currently high so that she doesn’t want to send ten separate transactions or even use payment batching to send one transaction that includes an output for each of the receivers. Instead, she wants to trustlessly commit to paying them in the future without having to pay onchain fees for ten outputs now. So Alice asks each of the receivers for one of their public keys and creates an unsigned and unbroadcast setup transaction that pays those keys using a 10-of-10 multisig script. Then she creates a child transaction that spends from the multisig output to the 10 outputs she originally wanted to create. We’ll call this child transaction the distribution transaction. She asks all the receivers to sign this distribution transaction and she ensures each person receives everyone else’s signatures, then she signs and broadcasts the setup transaction.

When the setup transaction receives a reasonable number of confirmations, there’s no way for Alice to take back her payment to the 10 receivers. As long as each of the receivers has a copy of the distribution transaction and all the others’ signatures, there’s also no way for any receivers to cheat any other receiver out of a payment. So even though the distribution transaction that actually pays the receivers hasn’t been broadcast or confirmed, the payments are secured by the confirmed setup transaction. At any time, any of the receivers who wants to spend their money can broadcast the distribution transaction and wait for it to confirm.

This technique allows spenders and receivers to lock in a set of payments during high fees and then only distribute the actual payments when fees are lower. According to Bitcoin Core fee estimates at the time of writing, anyone patient enough to wait a week for a transaction to confirm (like the distribution transaction above) can save significantly on fees. Let’s look at the example above in that context. To make later comparisons to Taproot more fair, we’ll assume some form of key and signature aggregation is being used, such as MuSig or (in theory) multiparty ECDSA (see Newsletter #18).

| Individual Payments | Batched Payment | Commit now, distribute later | |

|---|---|---|---|

| Immediate (high fee) transactions | 10x141 vbytes | 1x420 vbytes | 1x141 vbytes |

| Cost at 0.00142112 BTC/KvB | 0.00204641 | 0.00059687 | 0.00020037 |

| Delayed (low fee) transactions | — | — | 1x389 vbytes |

| Cost at 0.00001014 BTC/KvB | — | — | 0.00000394 |

| Total vbytes | 1,410 | 420 | 530 |

| Total cost | 0.00204641 | 0.00059687 | 0.00020431 |

| Savings compared to previous column | — | 71% | 66% |

We see that this type of trustlessly delayed payment can save 66% over payment batching and 90% over sending separate payments. Note that the savings could be even larger during periods of greater fee stratification or with more than ten receivers.

CheckOutputsHashVerify

The proposed soft fork would add a new opcode,

OP_CHECKOUTPUTSHASHVERIFY (abbreviated by its author as OP_COSHV

with an extra S). This opcode and a hash digest could be included in

tapleaf scripts, allowing it to be one of the conditions in a Taproot

address. When that address was spent, if COSHV was executed, the

spending transaction would only be valid if the hash digest of its

outputs matched the hash digest read from the script by COSHV.

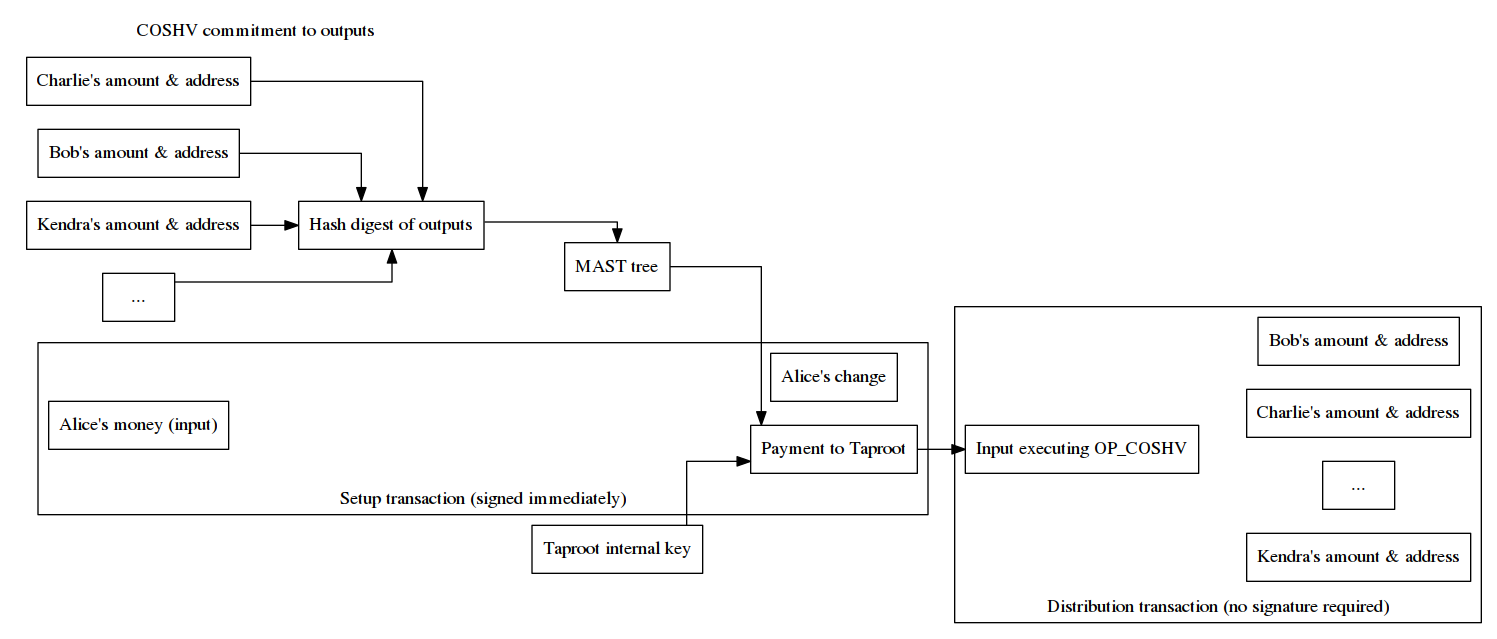

Comparing this to our example above, Alice would again ask each of the participants for a public key (such as a Taproot address2). Similar to before, she’d create 10 outputs which each paid one of the receivers—but she wouldn’t need to form this into a specific distribution transaction. Instead, she’d just hash the ten outputs together and use the resultant digest to create a tapleaf script containing COSHV. That would be the only tapleaf in this Taproot commitment. Alice could also use the participants’ public keys to form the taproot internal key to allow them to cooperatively spend the money without revealing the Taproot script path.

Alice would then give each of the receivers a copy of all ten outputs to allow each of them to verify that Alice’s setup transaction, when suitably confirmed, guaranteed them payment. When they later wanted to spend that payment, any of them could then create a distribution transaction containing the committed outputs. Unlike the example from the previous subsection, they don’t need to pre-sign anything so they would never need to interact with each other. Even better, the information Alice needs to send them in order to allow them to verify the setup transaction and ultimately spend their money could be sent through existing asynchronous communication methods such as email or a cloud drive. That means the receivers wouldn’t need to be online at the time Alice created and sent her setup transaction.

This elimination of the need to interact is a particular highlight of the proposal. If we imagine the example above with Alice being an exchange, the interactive form of the protocol would require her to keep the ten participants online and connected to her service from the moment each of them submitted their withdrawal request until the interaction was done—and they’d all need to use wallets compatible with such a child transaction signing protocol. The non-interactive form with COSHV would only require them to submit a Bitcoin address and an email address (or some other protocol address for delivery of the committed outputs).

Feedback and activation

The proposal received over 30 replies on the Bitcoin-Dev mailing list as of this writing. The concerns raised included:

-

● Not flexible enough: Matt Corallo says, “we need to have a flexible solution that provides more features than just this, or we risk adding it only to go through all the effort again when people ask for a better solution.”

-

● Not generic enough: Russell O’Connor suggests both COSHV and

SIGHASH_ANYPREVOUT(described in last week’s newsletter) could be replaced using anOP_CATopcode and anOP_CHECKSIGFROMSTACKopcode. Both opcodes are currently implemented in ElementsProject.org sidechains such as Liquid. TheOP_CATopcode catenates two strings into one string and theOP_CHECKSIGFROMSTACKopcode compares a signature on the stack to other data on the stack rather than to the transaction that contains the signature. Catenation allows a script to include various parts of a message that are combined with witness elements at spend time in order to form a complete message that can be verified usingOP_CHECKSIGFROMSTACK.Because the message that gets verified can be a Bitcoin transaction—including a partial copy of the transaction the spender is attempting to send—these operations allow a script to evaluate transaction data without having to directly read the transaction being evaluated. Compare this to COSHV which looks at the hash of the outputs and anyprevout which looks at all the other signatures in the transaction.

A potentially major downside of the cat/checksigfromstack approach is that it requires larger witnesses to hold the larger script and all of its witness elements. O’Connor noted that he doesn’t mind switching to more concise implementations (like COSHV and anyprevout) once it’s clear a significant number of users are making use of those functions via generic templates.

-

● Not safe enough: Johnson Lau pointed out that COSHV allows signature replay similar to BIP118 noinput, a perceived risk that bip-anyprevout takes pains to eliminate.

Rubin and others provided at least preliminary responses to each of these concerns. We expect discussion will be ongoing, so we’ll report back with any significant developments in future weeks.

The proposed BIP for COSHV suggests it could be activated along with bip-taproot (if users desire it). As bip-taproot is itself still under discussion, we don’t recommend anyone come to expect dual activation. Future discussion and implementation testing will reveal whether each proposal is mature enough, desirable enough, and enough supported by users to warrant being added to Bitcoin.

Overall, COSHV appears to provide a simple (but clever) method for allowing outputs to commit to where their funds can ultimately be sent. In next week’s newsletter, we’ll look at some other ways COSHV could be used to improve efficiency, privacy, or both.

Bech32 sending support

Week 11 of 24 in a series about allowing the people you pay to access all of segwit’s benefits.

Last week, we described one of the costs of not upgrading to bech32 sending support—users might think your service is out-of-date and so look for alternative services. This week, we’ll look at the stronger form of that argument: wallets which already can only receive to bech32 addresses. If the users of these wallets want to receive a payment or make a withdrawal from your service, and you don’t yet support sending to bech32 addresses, they’ll either have to use a second wallet or have to use one of your competitors.

- ● Wasabi wallet, known for its privacy-enhancing coinjoin mode and mandatory user coin control, only accepts payments to bech32 addresses. This relatively-new wallet was designed around compact block filters similar to those described in BIP158. However, since all of the filters are served by Wasabi’s infrastructure, the decision was made to minimize filter size by only including P2WPKH outputs and spends in the filter. This means the wallet can’t see payments to other output types, including P2SH for P2SH-wrapped segwit addresses.

- ● Trust wallet is a fairly new proprietary wallet owned by the Binance cryptocurrency exchange and compatible with Android and iOS. As a new wallet, they didn’t need to implement legacy address receiving support, so they only implemented segwit. That makes bech32 the only supported way to send bitcoins to this wallet.

-

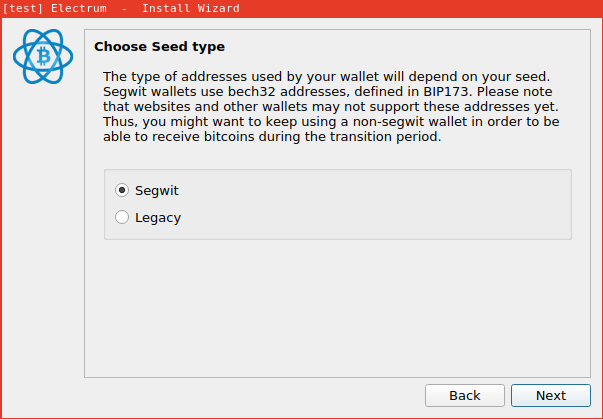

● Electrum is a popular wallet for desktop and mobile. When creating a new wallet seed, you can choose between a legacy wallet and a segwit wallet, with segwit being the current default. Users choosing a segwit wallet seed will only be able to generate bech32 addresses for receiving. Electrum warns users about the compatibility issues this may create with software and services that haven’t upgraded to bech32 sending support yet:

Please note that it’s neither required nor recommended for wallet authors to create a new seed in order to support a new address format. Other wallets, such as Bitcoin Core 0.16.0 and above, can produce legacy, p2sh-segwit, and bech32 addresses all from the same seed—the user just needs to specify which address type they want (if they don’t want the default).

As time goes on, we expect more new wallets to only implement receiving to the current best address format. Today that’s v0 segwit addresses for P2WPKH and P2WSH using bech32, but if Taproot is adopted, it will use v1 segwit addresses that will also use bech32. The longer your service delays implementing bech32 sending support, the more chance you’ll have of losing customers because they can’t request payments from you using their preferred wallet.

Correction to Newsletter #46: our section about bech32 QR codes incorrectly claimed that bech32 addresses used in BIP21 URIs with additional parameters couldn’t use the QR uppercase alphanumeric mode. Nadav Ivgi kindly informed us that QR codes could mix modes. We’ve updated that paragraph with the correct information, some additional details, and an additional set of QR code examples.

If you notice any errors in an Optech newsletter or any of our other documentation, please send us an email, a tweet, or otherwise contact one of our contributors.

Selected Q&A from Bitcoin Stack Exchange

Bitcoin Stack Exchange is one of the first places Optech contributors look for answers to their questions—or when we have a few spare moments of time to help curious or confused users. In this monthly feature, we highlight some of the top voted questions and answers made since our last update.

-

● What are the limitations for amortizing the interactive session setup of MuSig? Richard Myers is attempting to optimize interactive setup for a low bandwidth system, but user nickler emphasizes that nonces must not be reused or private keys could be leaked. Nickler goes on to provide suggestions to achieve Myers’s goal.

-

● On chain cost of Segwit version 1 versus version 0? User Wapac asks for a comparison of transaction weight between segwit v0 and v1, specifically for relatively simple single key transactions. Andrew Chow provides byte-level details and concludes that v1 is always cheaper to spend, while v0 can be cheaper to create an output. However, Andrew points out that the sender generally doesn’t have much choice in choosing which output type they send to, so users are likely to prefer v1 even for single key transactions. Wapac also provides an answer that shows a summary table.

-

● Does v1 Segwit include v0? Pieter Wuille states that no, you cannot use v0 scripts inside a v1 spend. He elaborates that the reason behind this is in order to meet some of the goals behind v1 leads to incompatibility with aspects of v0 script.

-

● Fee negotiations in Lightning. Mark H describes how, in an example four-hop LN payment, fees are negotiated.

Notable code and documentation changes

Notable changes this week in Bitcoin Core, LND, C-Lightning, Eclair, libsecp256k1, and Bitcoin Improvement Proposals (BIPs).

-

● LND #3098 increases the maximum number of blocks the daemon will wait for confirmation of a channel funding transaction initiated by a remote peer, raising it from 288 blocks (two days) to 2,016 (two weeks). This allows patient users to pay lower transaction fees.

-

● C-Lightning #2647 specifies a default plugin directory from which plugins will be automatically loaded even if the

--pluginor--plugin-dirconfiguration parameters are not specified. Currently this is thepluginsdirectory in the lightning daemon configuration directory. -

● C-Lightning #2650 adds a new plugin hook for when a remote peer tries to open a channel with the local node. This allows the plugin to reject the channel open or perform other actions before the channel is opened.

-

● Eclair #952 adds a

sendtoroutemethod that allows the users to manually select the channel through which a payment is initially routed. This can allow them to choose which channels get drained of funds. -

● Eclair #965 allows the user to specify the preimage when creating an invoice. This can be used for systems that securely generate unguessable invoice identifiers, such as an atomic swap or a set of contract terms combined with a nonce in the pay-to-contract format.

New publication schedule

Starting this week, the Optech newsletter will be published every Wednesday instead of every Tuesday. This will give us an extra weekday to review and edit newsletter drafts before we publish.

Special thanks

We thank Jeremy Rubin and Anthony Towns for their reviews of a draft of this newsletter, including describing to us the tree of outputs idea. We additionally thank Pieter Wuille for helping us better understand where interaction is required in aggregating keys and signatures with MuSig. Any errors in the published version of this newsletter are the fault of the author.

Footnotes

-

Segwit v0 (P2WSH) and the Tapscript proposal require the final stack contain only a single true element in order to succeed. This is called the cleanstack rule. Legacy script for bare outputs and P2SH outputs allows the stack to contain multiple items and succeed as long as the item at the top of the stack at its termination is true. However, legacy transactions that don’t have a clean stack will not be relayed or mined by Bitcoin Core’s default mempool policy. The cleanstack rule helps reduce transaction malleability as any addition or removal of extraneous elements to a scriptSig or witness will change a transaction’s feerate and (for legacy transactions) its txid. ↩

-

The proposed Taproot addresses format (v1 segwit addresses) includes a public key directly in the address, so anyone with a set of Taproot addresses can use them to create an aggregated pubkey. However, some users may create Taproot addresses using public keys for which no one has (or can plausibly generate) the corresponding private key. For that reason, anyone creating aggregated pubkeys should probably not assume that Taproot addresses are pubkeys themselves and should collect separate pubkeys. Additionally, it’s probably a good idea not to reuse the same pubkey in more than one place within Bitcoin. We omit the extra steps of collecting pubkeys in this newsletter’s examples in order to simplify the descriptions of COSHV. Please consider consulting with a Bitcoin expert before you implement the protocols you read about in the pages of this newsletter or anywhere else on the Internet. ↩